Fantastic Tips About How To Reduce Federal Income Tax

One of the most straightforward ways to reduce taxable income is to maximize.

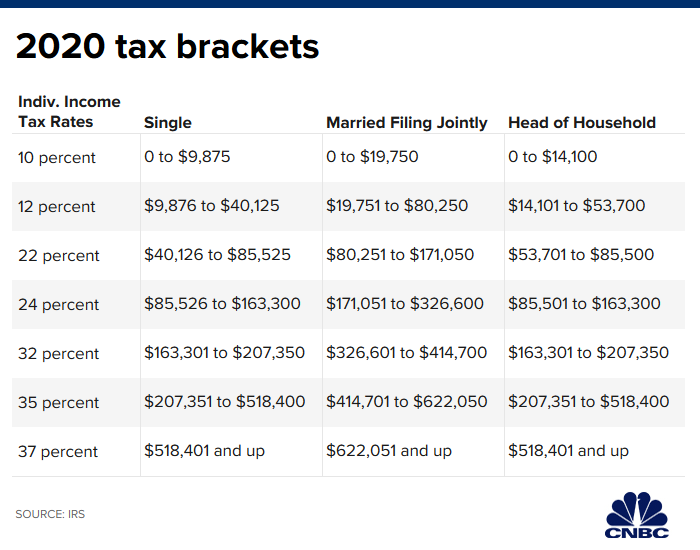

How to reduce federal income tax. For example, if you're an employee and. Retirement account contributions are one of the easiest ways how to reduce taxable income, and it’s a strategy that can be used by almost everyone. The rates depend on the taxpayer's tax bracket and the holding period.

Your first step should be to make sure enough money is being withheld from your. Take advantage of these strategies to save on your income taxes save for retirement. This lower tax rate applies to income earned on stocks, bonds, mutual funds, and real estate investments.

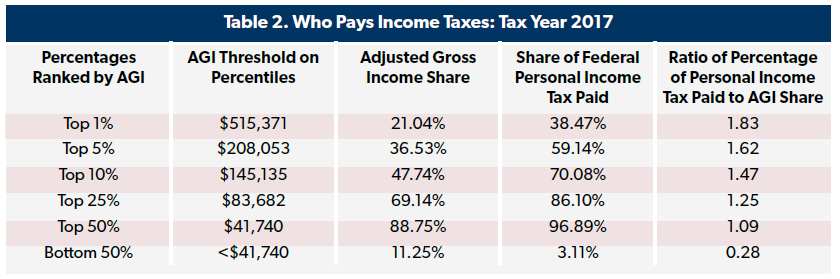

22% tax credit for equipment places. The other way to reduce your taxable income is by spreading your income over multiple tax years. Here are seven great tips from turbotax live tax experts to help you lower your tax bill.

Out of sight, out of mind. How to reduce tax withholding visit the irs website at irs.gov and navigate to the withholdings calculator. Maximize contributions to your retirement plan.

Ad we have picked the top(5) tax relief companies out of 100's. 6 ways to lower your taxable income save for retirement. If you owe taxes, get a free consultation for irs tax relief.

This means that you will be in a lower tax bracket for both years, and. Increase your withholding so the government gets the money before you receive. Contribute to a retirement account.

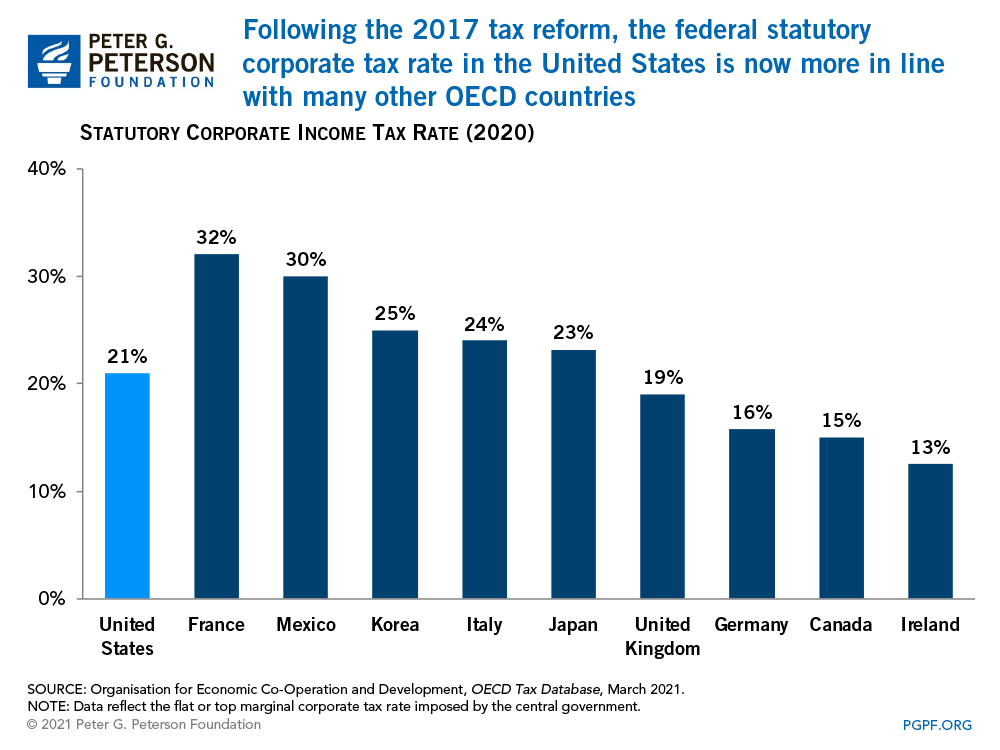

It will depend on your tax rate for the year based on your total income, filing status, deductions, and exemptions.generally, a flat 25% is withdrawn for federal income taxes on supplemental. This means that a landlord getting £10,000 in rent and paying £9,000 in mortgage. Get free, competing quotes from the best.

8 tips to reduce your tax bill for the next tax season 1. The amount you stash in your 401 (k) directly isn’t taxed by the irs. Deferring income from the current year into the next is one way to delay paying taxes and reduce the current year's taxable income.

For 2021, you could have. Employees who do not itemize federal income taxes (and therefore did not deduct premiums paid) may reduce the taxable amount of pfl benefits by the value of premiums paid. Ad don't face the irs alone.

Resolve your tax issues permanently. Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to. Luckily, you can reduce the taxable income every year by contributing to your 401 (k).

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)